Copper cathode production (hydrometallurgy processes) Leaching, solvent extraction (SX) and electrowinning (EW)

Copper market

Copper as an applicable metal especially in electrical industries has a significantly growing demand and supply shortage in the world. Electrical industries, building and construction, transportation and etc. are the main consumers of copper. Copper and its alloys are used in different types of wire and cable, tubes, valves, heaters and etc. copper global demand in 2025 will reach 28 million tons per year. Without construction of new industrial plants for copper production the gap between supply and demand will increase.

The World Bank forecasts copper price till 2025. Accordingly, copper price will rise to as much as 6,800 – 7,000 $/ton which represents an annual growth of 0.5% for copper price.

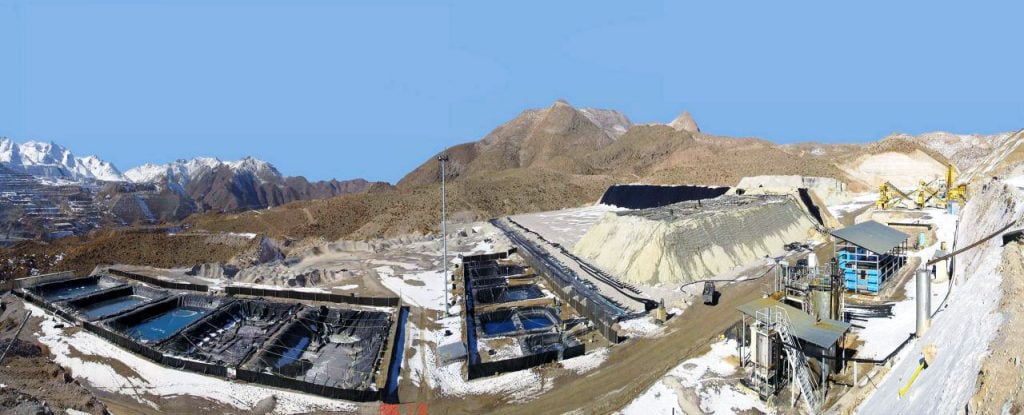

Copper Cathode Production

3% of the world’s copper mineral reserves are in Iran but Iran produces 1% of the world’s copper, though Iran has great potential in copper mining and copper cathode production especially by hydrometallurgical processes:

- The safe domestic and foreign market with specific and non-competitive prices

- Suitable oxide ore mines with limited reserves

- Open-pit copper mines and low costs of copper mining

- Domestic supply of the main raw materials required for the process

- low energy prices (especially natural gas)

- Low labor prices and skilled labors

- Great potential in the copper mining industry

- Access to target markets

Expert design and R&D departments make us capable of executing various industrial projects from idea to implementation.

ARAMICO